How To Apply For PayPal Business Loan | Instant PayPal Loan Without A Credit Check Ways To Sell Online

Introduction:

Business loans are sometimes hectic to apply for as they require some paper work or some difficult procedures, so there is always an alternate way that can help people more effectively. Therefore, PayPal is here to help you out, as it offers a variety of business loans that can help you grow and thrive. What’s great about these loans is that you can apply for them without worrying about a credit check.

In this article, we’ll discuss how to apply for a PayPal business loan, the different types available, and the benefits of choosing PayPal for your funding needs.

Understanding PayPal Business Loans

When you hear about PayPal, you have some confusion regarding it, like what it is or how it works, so there are answers to these questions.

What are PayPal Business Loans?

PayPal business loans are financing options that are made specifically for small businesses. These loans offer an easy approach to funding business owners that helps them expand their businesses.

How do they work?

The loan process with PayPal is relatively simple. PayPal uses data from your sales history to evaluate your eligibility and loan terms. This means they don’t rely on traditional credit checks, making the process much quicker and easier for many business owners.

Advantages of PayPal Business Loans

There are some advantages of PayPal Business loans that are as follows:

- The application process for a PayPal Business Loan is uncomplicated and can be completed online

- PayPal doesn’t require a credit check as part of the application process. This can be a great advantage for businesses which were established few years ago and do not have credit history.

- Once your application is approved, you’ll receive the funds quickly, usually within one business day.

Eligibility Criteria:

PayPal sets criteria for the application of business loans. If you are eligible for that, then you can get the funds very quickly. and you can start your business after that.

PayPal account status

To qualify for a PayPal business loan, you must have a PayPal business account in good standing.

This includes having a history of consistent sales.

There is a low risk of disputes or chargebacks.

Minimum sales requirements

PayPal will evaluate your eligibility based on your previous sales. Typically, they look for businesses that have at least $15,000 in annual sales

How to Apply for PayPal Business Loans:

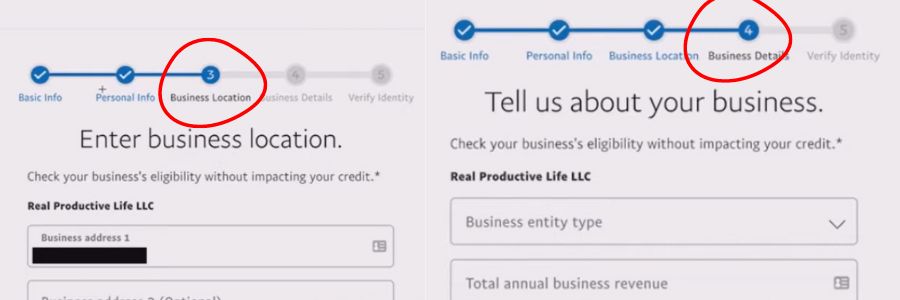

There are some steps to take for the PayPal business loan, which are basically questions that tell about you and your business.

- Make sure your PayPal account is in good standing and that you meet the minimum sales requirements.

- Fill out the form in which you have to tell PayPal about you and your business. It will take your bank account details and ask some security questions. It will take some few minutes.

- If you’re eligible, PayPal will give you a loan offer. Review the terms and conditions carefully to ensure they fulfills your business needs.

- Once you’ve reviewed the offer and agreed to the terms, accept the loan offer.

- After accepting the offer, you’ll receive your funds within one business day.

Conclusion:

PayPal offers credit check free business loans. They provide fast funding service which is about 1 business day. It offers a simple and practical option to obtain the financing you require to expand your business, with instant funding, no credit checks, and easy application processes.

FAQS:

Can you borrow money from PayPal business account?

Yes, you can borrow money from your PayPal business account through PayPal Working Capital or PayPal Business Loan, both offering convenient and quick funding options.

What credit score is needed for a PayPal loan?

Credit score is one consideration among many that PayPal takes into account for business loans. Instead of requiring a credit check, PayPal Working Capital looks at your past PayPal sales activity. For PayPal Credit, a decent credit score of roughly 700 is advised.

Can I borrow cash from PayPal Credit?

No, PayPal Credit does not provide direct cash loans. PayPal Credit isn’t meant for financial advances; instead, it’s for online shopping and payments.

YouTube Video Link For How To Apply For PayPal Business Loan | Instant PayPal Loan Without A Credit Check

I hope my blog is helpful for you, but if you want to see a live example and step-by-step guidance, then you can visit my YouTube channel. For a better understanding, you can view the video I made on YouTube on this subject by clicking this LINK.